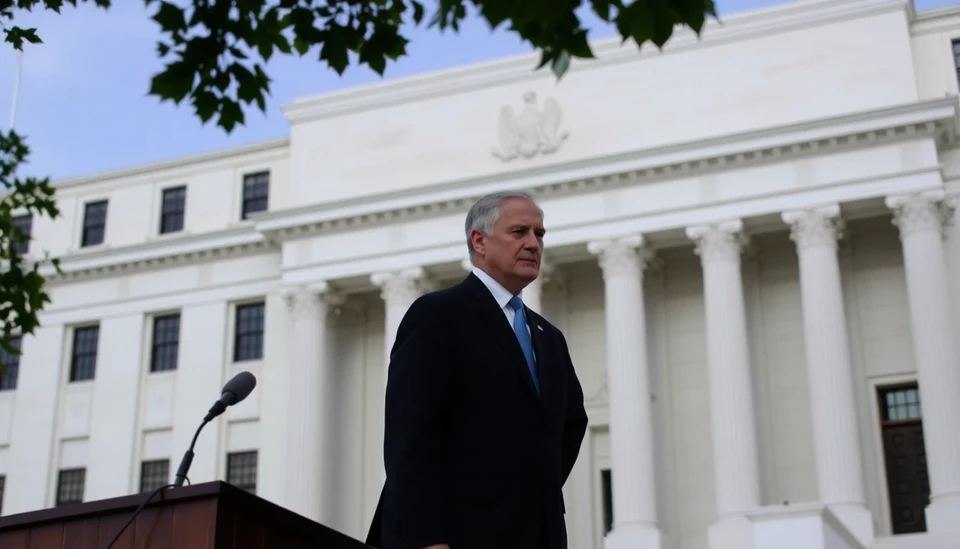

In a significant address delivered on February 11, 2025, Federal Reserve Chairman Jerome Powell emphasized the necessity of simplifying the language used by the Federal Reserve, particularly in light of rising apprehensions regarding debanking practices in the financial sector. Powell's remarks shed light on the institution's proactive approach to ensure better communication and understanding of monetary policy among the public and market participants.

The backdrop to Powell's commitment comes amid growing concerns about the stability of the banking system, which has seen a marked increase in the number of institutions cutting ties with certain clients categorized as high-risk. This phenomenon, known as debanking, has caught the attention of regulators and policymakers, prompting discussions around the implications it may have for financial inclusion and the overall economy.

During his address, Powell articulated the Federal Reserve's stance on maintaining transparency and accessibility in its communications. "We recognize that our use of complex language can create barriers for those who are trying to understand our policies," he noted. The Fed Chairman stated that simplifying the vocabulary and concepts used in official communications will allow for broader understanding and engagement from various stakeholders, from everyday depositors to seasoned investors.

Powell's reassurances come as public scrutiny over the banking system's responsiveness and accountability mounts, especially in the wake of recent bank failures and crises. The Chairman underscored that the Fed is actively responding to these challenges, not only by reforming its communication practices but also by reviewing regulatory frameworks that govern banking operations.

The disarray attributed to debanking practices raises critical questions about financial services equity, as some demographics find themselves disproportionately affected by banks severing ties due to perceived risks. Powell's focus on clearer communication is seen as a step towards fostering a more inclusive financial ecosystem where every individual has access to essential services.

In concluding his remarks, Powell reaffirmed the Federal Reserve's commitment to ensuring a stable and robust banking system while adapting to the evolving economic landscape. With clarity at the forefront of its strategy, the Fed aims to rebuild trust and enhance stability in a complex financial environment.

As concerns mount over the broader implications of debanking, both regulators and the public alike are poised to closely monitor how the Federal Reserve's proposed changes will manifest in practice. Moving forward, the focus will be on effective communication and ensuring that the principles of equity, stability, and transparency underlie all banking practices.

In a rapidly changing economic climate, Powell’s promise to streamline the Fed's manual language and respond to debanking issues highlights a pivotal moment in the ongoing conversation about the future of American finance.

#FederalReserve #JeromePowell #Debanking #FinancialInclusion #BankingReform #EconomicStability

Author: Daniel Foster