Japan's Banks Embrace Consolidation: Two Regional Lenders Forge Alliance

In a significant development within the Japanese banking landscape, two regional banks, the Kanto Bank and the Shikoku Bank, have announced plans to merge, marking a continued trend of consolidation among financial institutions in Japan. This decision is seen as a response to the challenging economic environment that has pressured smaller banks to seek efficiencies and strengthen their competitive position.

Continue reading

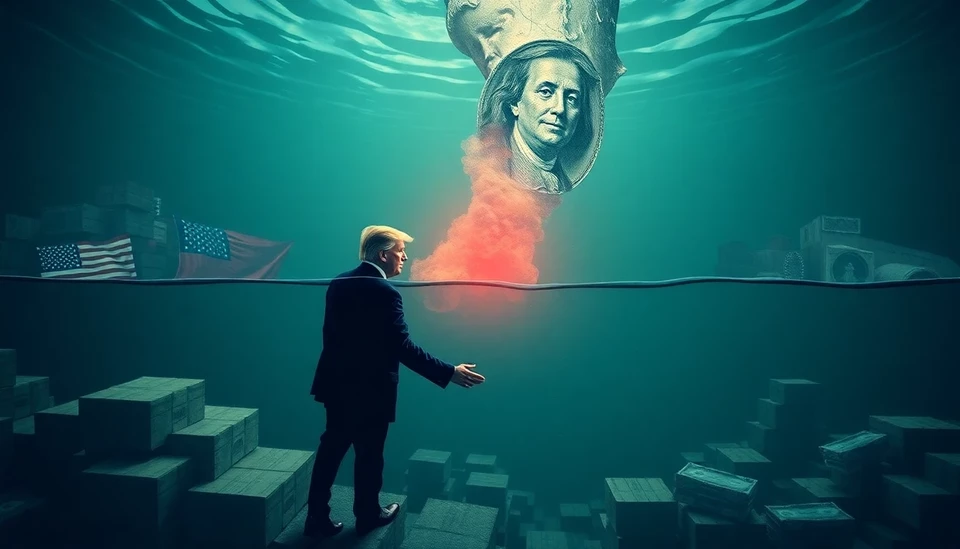

Trump's Tariffs and Central Banks: A Deep Dive into the Trade War Abyss

In a significant development in global economics, former President Donald Trump's administration is once again at the forefront of trade tensions, as looming tariffs threaten to engage the U.S. in a renewed trade war. The potential impact of these tariffs has central banks on high alert, prompting discussions around monetary policy adjustments and interest rate cuts as a preemptive measure to stabilize markets.

Continue reading

Santander Dethrones UBS: Now the Largest Bank in Continental Europe

In a significant shift within the banking landscape, Banco Santander has overtaken UBS to establish itself as the largest bank in continental Europe. This evolution comes on the heels of Santander's recent financial disclosures, which highlighted its robust performance and market capitalization that reached new heights, positioning it ahead of its Swiss competitor.

Continue reading

Beautiful Banks: The New Trend in Climate Finance Solutions

The world of finance is undergoing a remarkable pivot as a group of architects and urban planners take on an increasingly vital role in climate finance. These creative professionals are so convinced that aesthetics can drive investment towards more sustainable projects that they initiated a unique initiative called “Beautiful Banks.” They are proposing visual redesigns for financial institutions to make them more appealing and aligned with the global sustainability objectives.

Continue reading

Philippine Banks Exercise Caution Amid Global Trade Risks

In a recent assessment by the Monetary Board of the Philippines, local banks are exhibiting heightened caution towards trade financing due to rising global trade tensions and uncertainties. This cautious approach comes as a direct response to an unstable international economic landscape, which is affecting the local banking sector's appetite for risk.

Continue reading

Central Banks Unite in Response to U.S. Political Turmoil: A G-7 Initiative

In an unprecedented move, central banks from the G-7 nations are preparing their first coordinated response to the political chaos in the United States. This development comes as tensions run high within international markets, driven by the U.S. government’s instability and escalating partisan conflicts that threaten economic policies. With the financial repercussions being felt worldwide, central banks are stepping up to safeguard their economies from potential fallout.

Continue reading

European Banking Giants Unite to Strengthen Defense Sector Investment

In a significant step towards enhancing defense capabilities, major banks from across Europe have established a dedicated task force aimed at boosting investment in the defense sector. This initiative, launched on April 11, 2025, underscores the growing recognition among financial institutions of their pivotal role in national security and the importance of sustainable funding for defense initiatives.

Continue reading

Trump's Tariff Turbulence: A $700 Billion Storm Brewing for Major Banks

In a significant development that has sent ripples through the financial sector, the ramifications of former President Donald Trump’s tariff policies are unfolding into a colossal $700 billion crisis for major banking institutions. This disruption has reignited concerns among economists and financial analysts regarding the sustainability of the institutions at the forefront of international trade and finance.

Continue reading

Banking Sector Faces Challenges: Morgan Stanley Lowers Outlook Amid Rising Recession Fears

In a significant move reflecting growing concerns about the economic landscape, Morgan Stanley has officially downgraded the outlook for the banking sector. This decision is primarily influenced by an uptick in recession risks, leading analysts to reassess the potential performance and stability of banks moving forward.

Continue reading

Australian Central Bank Confident in Financial System Amid Potential US Tariffs

The Reserve Bank of Australia (RBA) has expressed a reassuring stance on the resilience of Australian banks in light of potential tariffs imposed by the United States. In a recent statement, the central bank conveyed its belief that the financial sector could withstand any negative impacts stemming from these international trade tensions.

Continue reading