Hedge Fund Fermat Left Reeling After GAM Termination of Contract

In a surprising turn of events, Fermat Capital Management, a hedge fund known for its innovative investment strategies, has publicly expressed shock and dismay following the abrupt termination of its contract by GAM Holding AG. This unexpected decision came as a significant blow to Fermat, which had been heavily reliant on its partnership with GAM for key aspects of its operations.

Continue reading

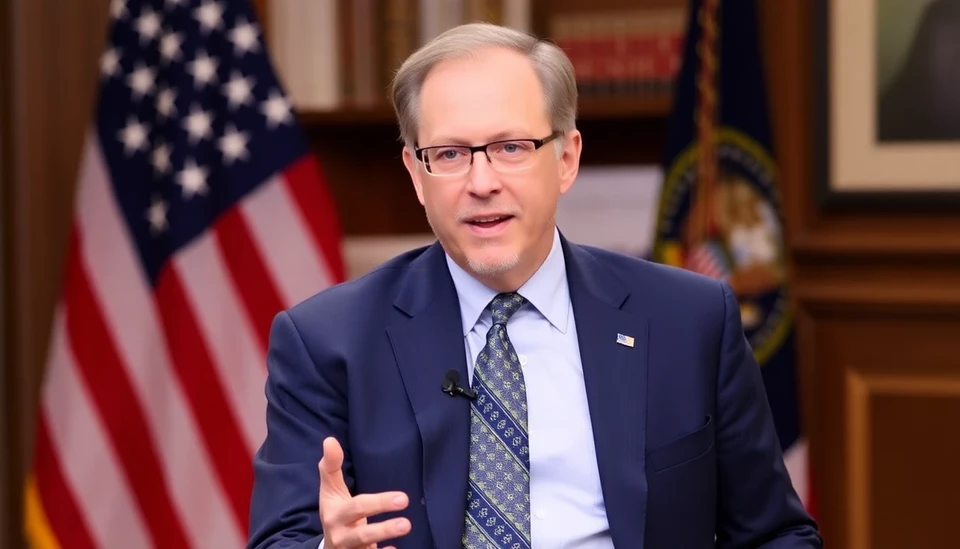

Steve Feinberg to Divest Cerberus Stake Amid Wealth Disclosure

In a significant move that could reshape the landscape of private equity, Steve Feinberg, the co-founder of Cerberus Capital Management, has made the decision to divest his stake in the investment firm. This announcement comes on the heels of a new regulatory requirement that mandates greater transparency regarding the wealth of high-profile private equity executives.

Continue reading

Italy's BPER Bank Considers First SRT as Popularity of Deals Grows

In a significant development within Italy's banking sector, BPER Banca is contemplating its first sale of a synthetic risk transfer (SRT) product. This move comes at a time when such financial instruments are increasingly gaining traction in the European market. The decision reflects BPER's efforts to bolster its capital position while managing risk more effectively amidst a landscape of rising competition and regulatory pressures.

Continue reading

Banco Santander's Strategic Shift: No Need for Unit Sales, Says CEO Botín

In a bold announcement, Banco Santander's executive chairman, Ana Botín, has emphasized the bank's capacity to reallocate capital internally rather than resorting to selling off business units. This declaration aligns with broader efforts to enhance profitability and streamline operations within the institution. The strategic pivot aims to improve overall efficiency while responding to evolving financial landscapes.

Continue reading

Major Shift: Banks Allocate $100 Billion to Investors Amid Easing Regulatory Pressures

In a significant financial pivot, banks have decided to distribute a staggering $100 billion to investors, signaling a newfound confidence as regulatory threats diminish. This dramatic outpouring of capital has drawn attention from markets and stakeholders alike, reflecting a change in the banking industry's approach to shareholder returns and capital management.

Continue reading

Nigeria's Access Bank Secures $228 Million in Rights Offering for Growth Initiatives

In a strategic move to bolster its capital base and support expansion plans, Nigeria's Access Bank has successfully completed a rights offering, raising a significant $228 million. This capital infusion is expected to provide the bank with the necessary financial resources to enhance its operations and pursue growth opportunities in both existing and new markets.

Continue reading

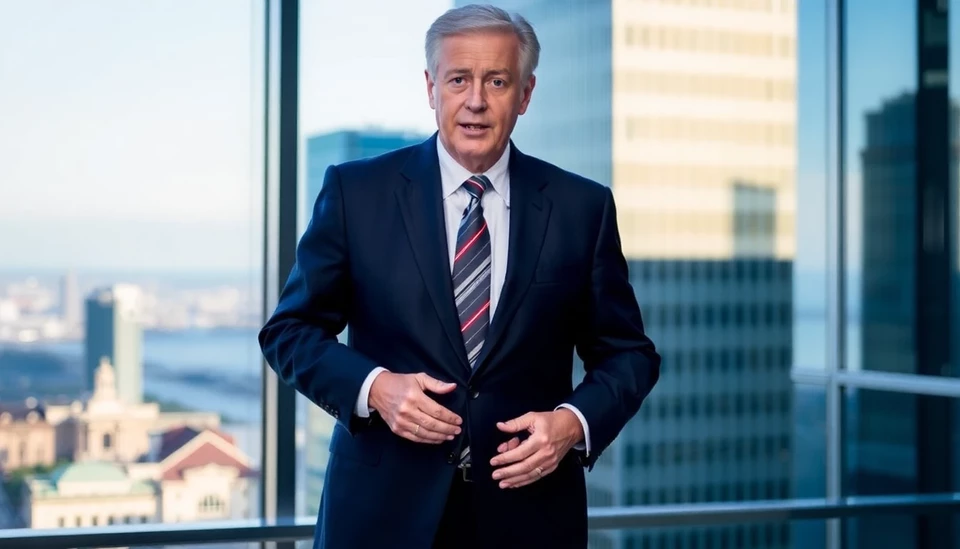

UniCredit's Orcel Poised to Unlock Capital Through Strategic SRT Deal

In a significant development within the banking sector, UniCredit’s CEO Andrea Orcel is reportedly preparing to unlock substantial capital through a potential landmark deal regarding a synthetic risk transfer (SRT) arrangement. This strategic maneuver could enable UniCredit to enhance its balance sheet and pursue further growth initiatives.

Continue reading