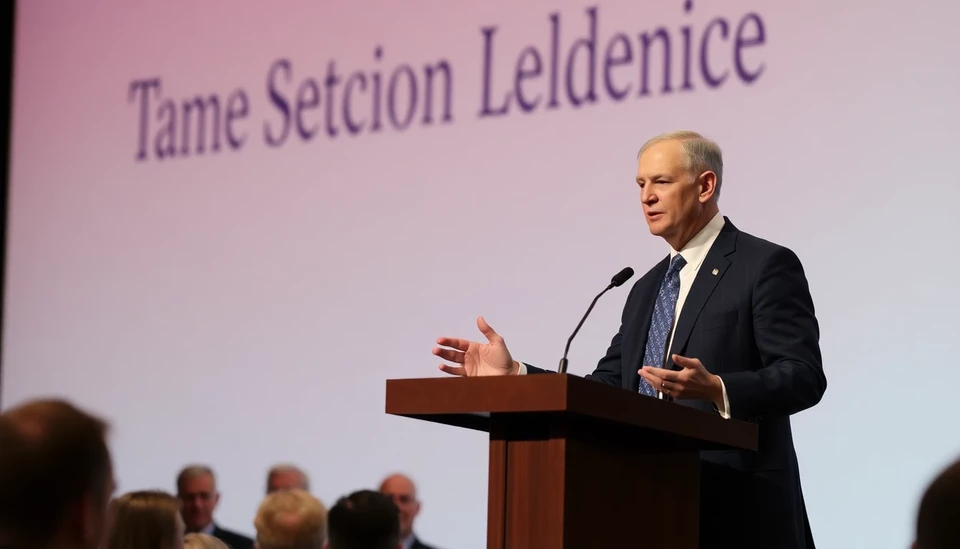

Federal Reserve Chair Jerome Powell Addresses Key Economic Issues at Chicago Event

In a pivotal address to the Economic Club of Chicago, Federal Reserve Chair Jerome Powell provided insightful commentary on a range of pressing economic issues facing the nation. Delivered on April 16, 2025, Powell's speech aimed to clarify the Federal Reserve's approach to monetary policy in light of evolving economic conditions, inflation trends, and the ongoing challenges in the labor market.

Continue reading

Bank of Canada Maintains Interest Rate Amid Trade Uncertainty

In a pivotal announcement on April 16, 2025, the Bank of Canada has decided to hold its key interest rate steady at 2.75%. This decision comes in the wake of ongoing trade tensions and an unclear economic landscape. The central bank made it clear that it would continue to monitor developments closely, particularly regarding international tariffs that could impact the Canadian economy.

Continue reading

St. Gobain Pauses $2.5 Billion Auto Glass Sale Amid Market Turbulence

In a significant development that underscores the ongoing volatility in global markets, French multinational Saint-Gobain has reportedly decided to stop the sale of its auto glass division, a deal valued at approximately $2.5 billion. This decision marks a pivotal turn for the company, which had been in discussions to divest its automotive glass operations as part of a broader strategy aimed at restructuring its portfolio.

Continue reading

Peru's Inflation Rate Slows to 1.28% in March, But Falls Short of Forecasts

In a recent financial update, Peru's inflation rate recorded a decrease, landing at 1.28% in March. This figure, though indicating a slowdown, was still below the expectations set by economists who had predicted a more significant drop. Many analysts were looking forward to inflation rates easing further amid a backdrop of economic recovery in the region.

Continue reading

UK Trade Data Release Delayed Following Errors Identified by Statistics Authority

The Office for National Statistics (ONS) in the United Kingdom has announced a significant postponement of the forthcoming trade data release, citing errors that demand immediate attention. This unexpected decision has raised concerns among economists and market analysts, who eagerly await accurate trade statistics to better understand the state of the UK economy.

Continue reading

U.S. Consumer Prices Show Promising Trends in February Report

In a significant update for the U.S. economy, the Consumer Price Index (CPI) report for February has been released, revealing essential insights into inflationary trends that are shaping the financial landscape. The CPI, which is a critical measure of inflation and reflects the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, showed varied results this month.

Continue reading

Unexpected Surge in Sweden’s Core Inflation Reaches Eight-Month High

In a surprising twist for the Swedish economy, data released on February 6, 2025, indicated that core inflation has surged to its highest level in eight months, sending ripples through financial markets and shaking expectations for monetary policy movements. The recent figures show a significant increase, catching analysts off guard as they navigate the complexities of the current economic landscape.

Continue reading

Istanbul Sees a Significant Surge in Consumer Prices: January 2025 Update

The latest report from Istanbul reveals a notable increase in the Consumer Price Index (CPI) for January 2025, which has experienced a rise of 5.16%. This uptick is a continuation of a concerning trend, as inflationary pressures remain a significant challenge for consumers and policymakers alike in Turkey.

Continue reading

Surprising Surge: UK Mortgage Approvals Rise Unexpectedly in December

In a surprising turn of events, the UK housing market witnessed a notable increase in mortgage approvals for the month of December 2023, defying expectations of a continued downturn. Despite a backdrop of rising interest rates and ongoing cost-of-living pressures, data from the Bank of England reveals that mortgage approvals rose to 66,702, significantly higher than the anticipated figures of around 60,000.

Continue reading

South Korea Sees Significant Drop in Household Loans, Easing Debt Worries for the BOK

Recent data from the Bank of Korea (BOK) reveals a promising decline in household loans, a development that is likely to alleviate concerns surrounding mounting household debt in the nation. As of January 2025, total household loans in South Korea saw a decrease of 3.5 trillion won ($2.7 billion), reaching a total of approximately 1,894 trillion won. This marks the first contraction in household lending figures since August 2021, reflecting substantial shifts in consumer behavior and market conditions.

Continue reading