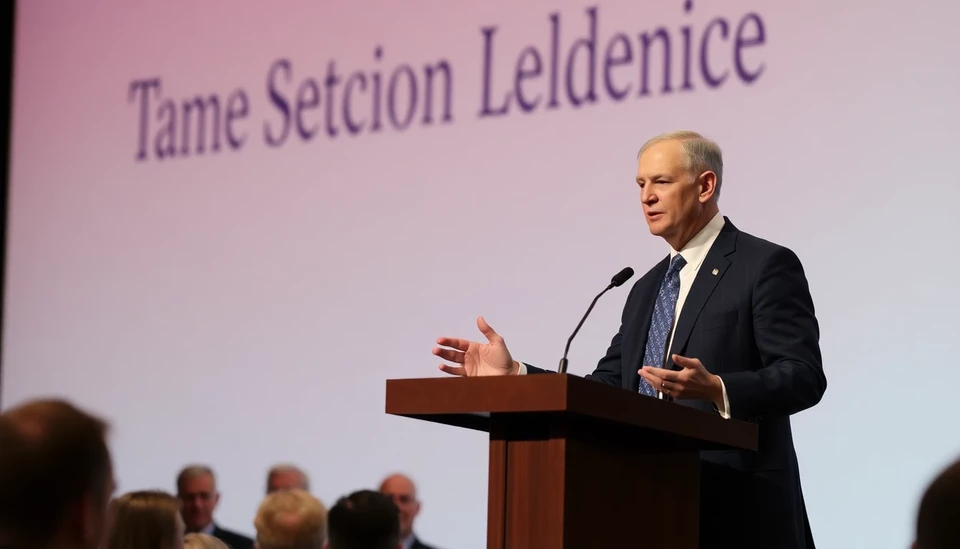

In a pivotal address to the Economic Club of Chicago, Federal Reserve Chair Jerome Powell provided insightful commentary on a range of pressing economic issues facing the nation. Delivered on April 16, 2025, Powell's speech aimed to clarify the Federal Reserve's approach to monetary policy in light of evolving economic conditions, inflation trends, and the ongoing challenges in the labor market.

Powell began his remarks by acknowledging the resilience of the U.S. economy, citing a robust recovery in the face of post-pandemic uncertainties. However, he emphasized that this recovery is not without its challenges. Inflation has remained notably above the Fed's 2% target for an extended period, prompting ongoing discussions about the appropriate monetary response. Powell reiterated the Fed's commitment to achieving price stability, which he labeled as “imperative for sustainable economic growth.”

Throughout his address, Powell underscored the importance of careful navigation in the current economic climate. He discussed the potential implications of further interest rate adjustments, noting that the Fed must weigh the risks of inflation against the need to support ongoing recovery and job growth. “We are committed to using our tools to combat high inflation. However, we must also be mindful of the necessity to nurture employment levels,” he stated.

Powell also touched on the labor market, which, while recovering, continues to show signs of strain. He highlighted the challenges faced by certain sectors, particularly in terms of talent shortages and wage pressures. “We are witnessing a shift in the labor market dynamics, and it is crucial that we adapt our monetary policy to address these unique circumstances,” he explained. This adaptability, he noted, would be central to the Fed's approach moving forward.

In a Q&A session following his speech, Powell addressed specific concerns raised by audience members regarding the implications of geopolitical tensions and supply chain disruptions on the American economy. He acknowledged that these global factors have contributed to inflationary pressures and expressed optimism that the Fed's measures would ultimately stabilize the economy.

Ending on a note of cautious optimism, Powell reiterated the Fed’s dual mandate of promoting maximum employment while ensuring price stability. He called for patience and understanding from the public, promising that the Federal Reserve would act decisively and transparently in its efforts to navigate the intricate economic landscape.

The event not only brought forth critical economic insights but also fostered an engaging dialogue between Powell and business leaders, policymakers, and economists, signaling a collective commitment to collaboration in addressing the challenges ahead.

As the nation looks towards the future, Powell's words serve as a reminder of the delicate balance that the Federal Reserve must maintain in its policy making—a balance that is essential for fostering a resilient economy capable of withstanding both domestic and international pressures.

#FederalReserve #JeromePowell #EconomicUpdate #MonetaryPolicy #Inflation #LaborMarket #EconomicRecovery #Chicago

Author: Laura Mitchell