China's LNG Imports Face Continued Decline as Demand Weakens

In a notable trend for the energy sector, China's liquefied natural gas (LNG) imports are set to experience an extended slump throughout April 2025, reflecting a significant slowdown in domestic demand. This downturn is influenced by a combination of factors including escalating global prices, competition from alternative energy sources, and lackluster industrial activity within the country.

Continue reading

India Reduces LNG Imports as Alternative Fuels Gain Appeal

In a significant shift in its energy procurement strategy, India has decided to curtail its purchases of liquefied natural gas (LNG) in response to the rising attractiveness of alternative fuels. This move comes amid fluctuating global energy prices and a drive for diversification in energy sources, reflecting a broader trend in the country's energy sector.

Continue reading

GE Vernova Ramps Up Gas Turbine Production Amid Rising Global Power Demand

In a significant move to capitalize on the surging demand for power generation, General Electric's Vernova division has announced a robust increase in its gas turbine production backlog. This response comes as energy markets worldwide grapple with accelerating demand for electricity fueled by economic recovery, population growth, and increasing reliance on electrification across various sectors.

Continue reading

Oil Prices Surge Amid Geopolitical Tensions and Supply Concerns

As the global oil market continues to experience volatility, recent developments have led to significant fluctuations in oil prices. On April 22, 2025, crude oil prices have surged, driven by increasing geopolitical tensions in key oil-producing regions.

Continue reading

TC Energy Dismisses Mainline Sale Amidst Canada’s Oil Security Push

In a significant development for the Canadian energy sector, TC Energy has ruled out the sale of its Mainline pipeline system. This decision comes at a time when the Canadian government is prioritizing oil security and dependence. The Mainline, which plays a critical role in transporting crude oil from Western Canada to key markets in the United States, has been under scrutiny as the country navigates its energy needs and climate goals.

Continue reading

China's LPG Market: A Surge in Demand and Soaring Prices Amid Supply Adjustments

In a significant shift in the global liquefied petroleum gas (LPG) landscape, Chinese buyers are scrambling to replace the void left by reduced imports from the United States. This rush has ignited a dramatic increase in LPG prices, marking a noteworthy development in the energy sector as China seeks alternative sources to meet its soaring demand.

Continue reading

Texas Struggles to Revitalize Gas-Fired Power Amidst Economic Challenges

In a bid to reignite its gas-fired power sector, Texas is facing significant hurdles that could hinder its ability to meet rising energy demands. The state, known for its robust energy production, has been attempting to capitalize on natural gas as a vital source of electricity in the wake of shifting market dynamics. However, recent developments suggest that efforts to kickstart new gas plants are faltering under various pressures.

Continue reading

Big Oil Transforms into Big Gas: The Impact of EVs on China's Energy Landscape

In a dramatic shift reflecting the evolving energy dynamics in China, major oil companies are increasingly pivoting towards natural gas. This transformation comes amidst a significant decrease in fuel demand spurred by the rise of electric vehicles (EVs) in the country. The growing popularity of EVs has not only reshaped consumer preferences but has also raised critical questions about the future profitability of traditional oil-based revenues for these firms.

Continue reading

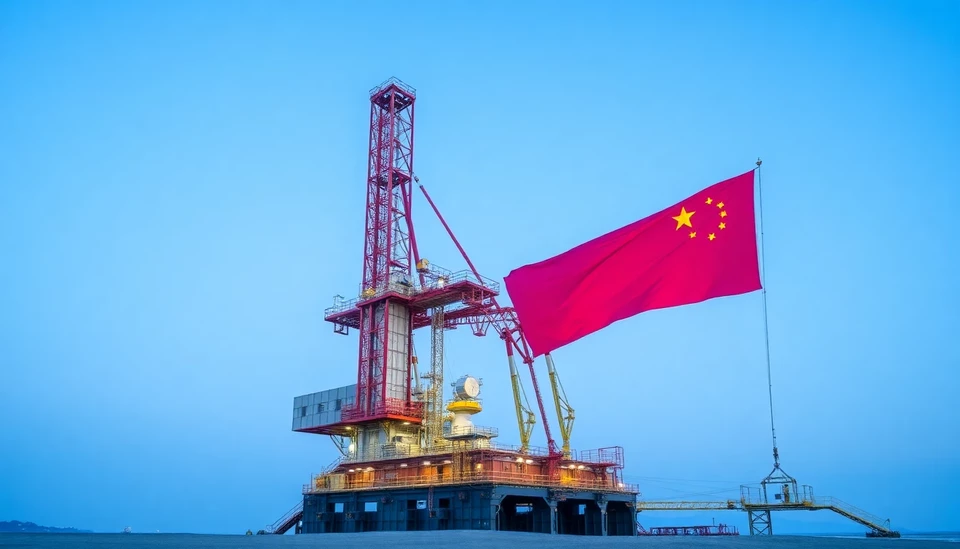

PetroChina Reports Slight Profit Growth Amid Rising Oil Production

In a recent announcement, PetroChina, one of the largest oil and gas companies in the world, revealed a modest increase in its profits for the fiscal year 2024. The company reported a profit rise of approximately 2%, attributing this growth primarily to enhanced oil production capabilities. The findings reflect PetroChina's ongoing efforts to boost its production levels and adapt to fluctuating market demands.

Continue reading

European Power Prices Decline as Solar Energy Surges Amidst Changing Market Dynamics

In a significant shift in the European energy market, peak power prices have been experiencing noticeable pressure, attributed to the rapid expansion of solar energy generation across the continent. This trend is reshaping the traditional electricity pricing dynamics and is expected to have lasting implications for both consumers and energy producers.

Continue reading