Fed and FDIC to Reassess Community Reinvestment Act Rules Amid Banking Scrutiny

The Federal Reserve (Fed) and the Federal Deposit Insurance Corporation (FDIC) have announced plans to withdraw a final rule related to the Community Reinvestment Act (CRA), a pivotal law that encourages banks to meet the credit needs of underserved communities. This withdrawal comes at a time when both agencies are under increased pressure to evaluate the effectiveness of banking regulations in promoting fair lending and equitable access to financial services.

Continue reading

Mobile Money Platform Mukuru Aims for Significant Expansion in Africa

Mukuru, a prominent mobile money service provider, is setting its sights on substantial growth across the African continent. The company has announced ambitious plans to enhance its business footprint and deliver financial services to an even larger segment of the population.

Continue reading

Kuwait Makes Historic Move to Allow Banks to Offer Mortgages

In a groundbreaking development for the financial landscape of Kuwait, the Central Bank has announced plans to allow local banks to offer mortgage lending for the very first time. This significant policy shift is poised to revolutionize access to home ownership for many Kuwaitis and enhance the overall functionality of the housing market.

Continue reading

Affirm Partners with Experian to Enhance Buy Now, Pay Later Transparency

In a significant move for the Buy Now, Pay Later (BNPL) sector, Affirm, a leading financial technology company, announced plans to share comprehensive data related to its BNPL transactions with Experian, one of the foremost credit reporting agencies. This collaboration is set to reshape how consumers are viewed in terms of creditworthiness and financial reliability.

Continue reading

Complex ESG Risk Regulations Pose Challenge for Small European Banks, Warns Kukies

Regulatory landscape in Europe surrounding Environmental, Social, and Governance (ESG) risk management is becoming increasingly convoluted, potentially hampering the competitiveness and operations of smaller banks. This assertion comes from a recent commentary by European banking authority executive, Bernd Kukies, who emphasizes that the complexity of these regulations is not only burdensome but may also lead to unintended disparities within the banking sector.

Continue reading

European Central Bankers Advocate for Streamlined Lending Regulations

In a recent development that could reshape the landscape of banking in Europe, leading officials from the European Central Bank (ECB) are urging for a reevaluation of complex lending regulations that govern financial institutions across the continent. This push for simplification is rooted in the desire to enhance the operational efficiency of banks while ensuring that they remain robust against potential economic downturns.

Continue reading

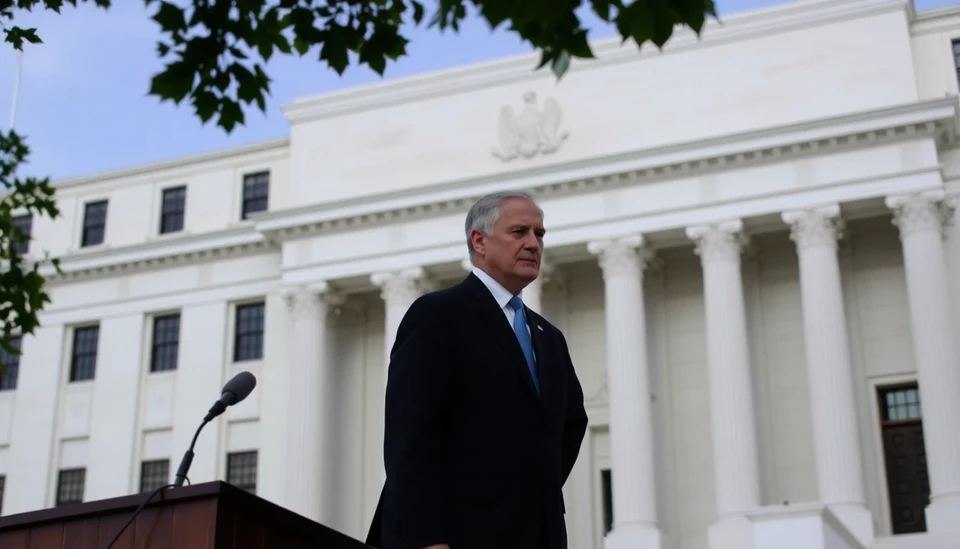

Fed Chair Jerome Powell Seeks Clarity Amid Debanking Concerns

In a significant address delivered on February 11, 2025, Federal Reserve Chairman Jerome Powell emphasized the necessity of simplifying the language used by the Federal Reserve, particularly in light of rising apprehensions regarding debanking practices in the financial sector. Powell's remarks shed light on the institution's proactive approach to ensure better communication and understanding of monetary policy among the public and market participants.

Continue reading

Kenya's Central Bank Takes Strong Measures to Drive Down Loan Rates

The Central Bank of Kenya (CBK) has recently escalated its efforts to reduce the high interest rates that have burdened consumers and businesses alike. In a bold move, the CBK is now leveraging its regulatory powers to enforce a more favorable lending environment. This initiative is aimed at stimulating economic growth across the nation and making credit more accessible to the average Kenyan.

Continue reading

Direct Lending to Small Businesses: A New Frontier Worth Exploring

In a recent statement, the CEO of a prominent financial institution emphasized the growing need for direct lending options tailored to small businesses. This approach, he argues, not only holds the potential to address funding gaps but also to stimulate economic growth by providing necessary capital to the backbone of the economy.

Continue reading

The Future of Money: Are Digital Payments Leading to a Cashless Australia?

Recent discussions have emerged in Australia regarding the rapid transition to digital payment methods and its implications on cash usage in the country. As digital transactions continue to gain momentum, questions arise about the potential for cash to become obsolete in the not-so-distant future.

Continue reading