P&G Adjusts Sales Forecast Amid Uncertain Market Conditions

Procter & Gamble (P&G), a leading name in consumer goods, has revised its sales guidance, attributing the change to ongoing volatility in market conditions. This adjustment underscores the challenges faced by many companies in navigating economic uncertainties and fluctuating consumer behavior.

Continue reading

Norway's $1.7 Trillion Wealth Fund Faces Tech Stock Losses Amid Market Fluctuations

In a comprehensive financial report released recently, Norway's sovereign wealth fund, recognized as the largest in the world with assets totaling $1.7 trillion, has acknowledged a significant downturn driven predominantly by its investments in technology stocks. The report highlights that the fund experienced a notable decrease in value, attributed largely to volatility in the tech sector, which has been characterized by fluctuating investor sentiment and market dynamics.

Continue reading

Philip Morris Halts Sale of Cigar Division Amidst Volatile Market Conditions

In a significant business pivot, Philip Morris International Inc. has decided to put the brakes on the sale of its U.S. cigar business. The company cites ongoing market volatility as the primary reason for this unexpected move, which has sent ripples through the cigar industry and raised eyebrows among investors and market analysts alike.

Continue reading

Japan's Kato to Intensify Foreign Exchange Dialogue with Bessent This Week

In a pivotal move for the global financial landscape, Japan's Vice Finance Minister for International Affairs, Masato Kato, is set to engage in discussions with the influential investor and founder of “Investment Group”, David Bessent, this week. This meeting marks an important step towards enhancing cooperation on foreign exchange policies amid rising global economic uncertainties.

Continue reading

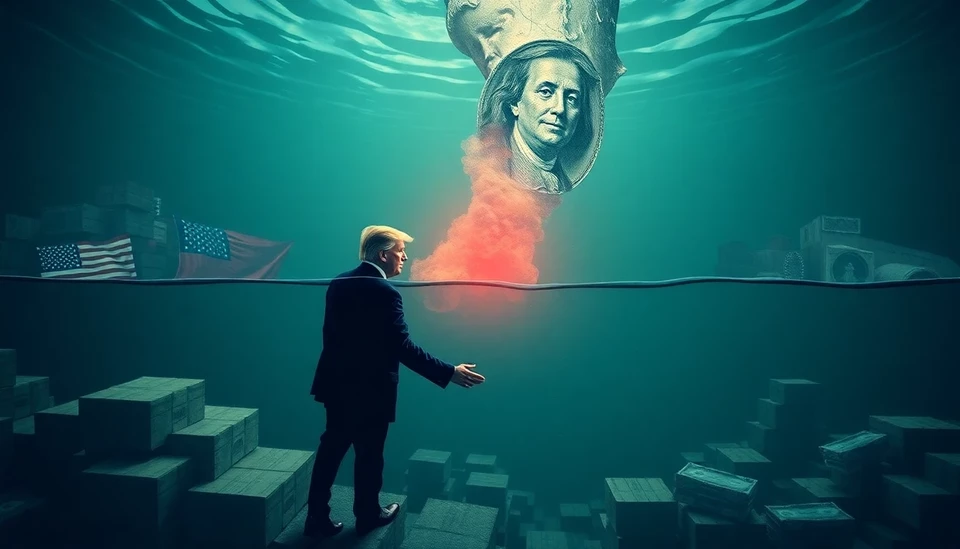

Global Central Bankers Navigate Chaos Amid Trump’s Trade War

In a dramatic turn of events, former President Donald Trump has reignited tensions in the global economy with the reimposition of tariffs on various imports. This move has sent shockwaves through international markets, compelling global central bankers to grapple with the complexities of a crumbling trade landscape. The reintroduction of these tariffs not only revives concerns over potential inflation but also tests the resilience of financial institutions across the globe.

Continue reading

Trump's Tariffs and Central Banks: A Deep Dive into the Trade War Abyss

In a significant development in global economics, former President Donald Trump's administration is once again at the forefront of trade tensions, as looming tariffs threaten to engage the U.S. in a renewed trade war. The potential impact of these tariffs has central banks on high alert, prompting discussions around monetary policy adjustments and interest rate cuts as a preemptive measure to stabilize markets.

Continue reading

Roko's Consistent Profitability from the Volatile Trump Era Market

In a landscape where market stability is akin to a unicorn, a trading strategy developed by Roko is standing out for its remarkable ability to maintain profitability amid the chaotic swings of the stock market influenced by political events, particularly those surrounding the former president Donald Trump. While many investors find themselves grappling with uncertainty, Roko has harnessed this volatility to generate significant returns.

Continue reading

Charles Schwab Surges Past Expectations Amid Market Volatility

In a remarkable display of resilience during uncertain financial times, Charles Schwab Corporation has reported trading figures that significantly exceed analysts' estimates for the first quarter of 2025. The leading brokerage firm attributed this success to its customers' increased trading activity as they navigated a tumultuous stock market landscape.

Continue reading

Yen Faces Increased Volatility Ahead of Key Finance Minister Discussions

The Japanese yen is bracing for potential volatility as traders gear up for critical discussions led by Japan's Finance Minister. As the market anticipates fresh insights into economic policies, many are left speculating on the short and long-term impacts this could have on the currency.

Continue reading

Liberty’s Profits Dive to Three-Year Low Amidst Oil Price Collapse

In a significant downturn for the energy sector, Liberty Energy Inc., a prominent player in the fracking industry, has reported its profits plummeting to a three-year low. This alarming decline comes as oil prices experience a notable slump, raising concerns about the overall health of the market. The latest financial report reveals that Liberty's net income dropped by more than 60% compared to the previous year, a clear indication of the challenges the company is facing in a fluctuating economic landscape.

Continue reading