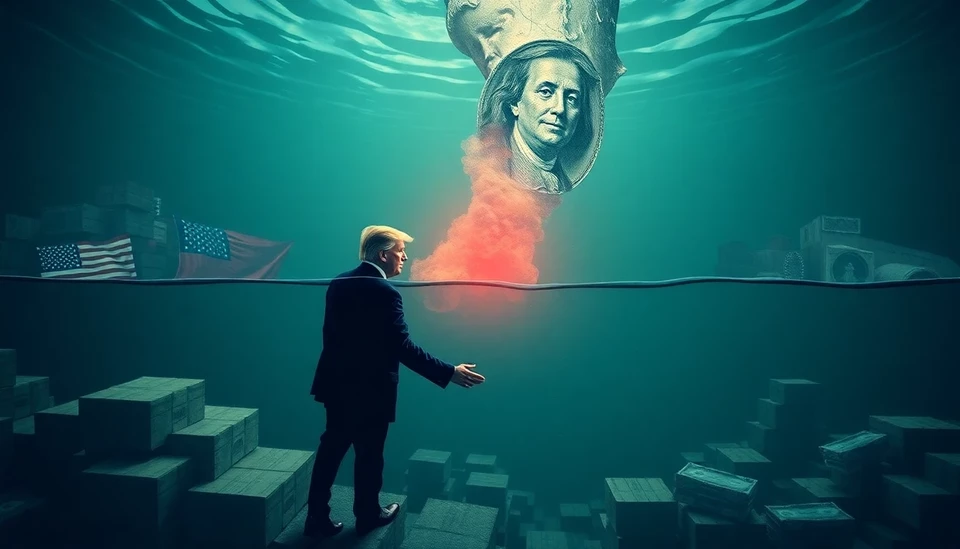

Trump's Tariffs and Central Banks: A Deep Dive into the Trade War Abyss

In a significant development in global economics, former President Donald Trump's administration is once again at the forefront of trade tensions, as looming tariffs threaten to engage the U.S. in a renewed trade war. The potential impact of these tariffs has central banks on high alert, prompting discussions around monetary policy adjustments and interest rate cuts as a preemptive measure to stabilize markets.

Continue reading

Central Banks Unite in Response to U.S. Political Turmoil: A G-7 Initiative

In an unprecedented move, central banks from the G-7 nations are preparing their first coordinated response to the political chaos in the United States. This development comes as tensions run high within international markets, driven by the U.S. government’s instability and escalating partisan conflicts that threaten economic policies. With the financial repercussions being felt worldwide, central banks are stepping up to safeguard their economies from potential fallout.

Continue reading

Major Central Banks Maintain Interest Rates Amid Rising Tariff Concerns

In a pivotal move for the global financial landscape, the Federal Reserve (Fed), the Bank of Japan (BoJ), and the Bank of England (BoE) have all decided to keep their key interest rates unchanged. This decision comes against the backdrop of increasing tariff tensions and economic uncertainty, prompting central banks to adopt a cautious approach to monetary policy.

Continue reading

Bank of France Faces Increased Losses Amid Rising ECB Policy Costs

The Bank of France has reported a significant widening of its losses, attributing the downturn largely to the financial implications of European Central Bank (ECB) policies aimed at stimulating the economy. As policy measures, such as low interest rates and large-scale asset purchases continue, central banks across Europe are experiencing mounting pressure on their financial standings.

Continue reading

The Rise of Social Media: Central Banks Engage with Gen Z to Foster Financial Literacy

In a groundbreaking shift, central banks around the world are increasingly turning to social media platforms as a means to engage and educate Generation Z about financial literacy, economic policies, and the importance of banking systems. Recognizing the digital natives' reliance on online channels for information, these financial institutions are adapting their communication strategies to effectively connect with younger audiences.

Continue reading

Persistent Global Inflation Poses Challenges for Policymakers

Global inflation rates continue to exhibit a stubborn stickiness, raising concerns among economic leaders like Thomas Jordan, the head of Switzerland's central bank. Despite previous predictions that inflationary pressures would ease, recent data suggests that underlying price increases remain resilient, complicating the task of monetary policymakers worldwide.

Continue reading

Federal Reserve Exits Global Climate Coalition, Sparking Debate on Sustainability Commitment

In a surprising move that has sent shockwaves through financial and environmental circles, the Federal Reserve has officially withdrawn from a prominent global coalition focused on climate change initiatives. This decision has ignited discussions surrounding the future of sustainability efforts and the role of central banks in combating climate-related issues.

Continue reading

Central Banks Take Center Stage: Interest Rate Projections for 2025

As we step into 2025, central banks worldwide are under intense scrutiny as they navigate a mixed economic landscape and ponder the implications of adjusting interest rates. The ongoing challenges faced by economies, which include inflationary pressures and labor market fluctuations, have provoked keen interest in how these financial institutions will steer monetary policy moving forward.

Continue reading

Central Banks Navigate a Cautious Path Amid Interest Rate Cuts and Economic Uncertainty

As central banks around the globe approach a pivotal moment in monetary policy, the specter of former President Donald Trump's financial decisions looms large, influencing the cautious strategies of officials readying for potential cuts in interest rates. The economic landscape has become increasingly complex, compelling policymakers to weigh the intricate balance between stimulating growth and maintaining inflation targets.

Continue reading

Key Insights from 2024: A Comprehensive Recap of Economic Trends

As we wrap up 2024, the "Odd Lots" podcast has delivered a captivating analysis of ten pivotal takeaways from the year. This reflective overview highlights significant economic shifts, trends, and noteworthy developments that shaped not only markets but also the broader economic landscape throughout the year. Here’s a detailed retelling of the most interesting insights shared in this engaging recap.

Continue reading