Bank of America’s Board of Directors Secures Strong Investor Backing

In a significant development for one of the United States’ most prominent financial institutions, Bank of America has successfully secured the endorsement of its slate of directors during the recent annual shareholder meeting. This approval marks a decisive moment for the bank, further solidifying its leadership and governance structure amid countless challenges facing the banking sector.

Continue reading

Major Setback for Energy Venture Founded by Trump's Former Executive: Analyzing a 40% Stock Plunge

In a startling turn of events, shares of a major energy company founded by former Trump administration official and executive Rick Perry have plummeted by 40%. This steep decline raises critical questions about the future of the firm, as well as the broader implications for the U.S. oil industry amid ongoing market volatility. The sudden drop has shocked investors, prompting analyses from industry experts and market watchers alike.

Continue reading

Sunnova Faces Uncertain Future as Bankruptcy Looms

In a troubling turn of events, Sunnova Energy International Inc., a prominent player in the solar energy sector, is grappling with potential bankruptcy as it seeks a crucial lifeline from creditors. Reports suggest that the renewable energy company is struggling to negotiate terms with its debt holders, which could ultimately determine its fate in the competitive industry.

Continue reading

Yellen Addresses Treasury Market Dynamics Amidst Eroding Confidence

In a recent statement, U.S. Treasury Secretary Janet Yellen provided insights into the current state of the U.S. Treasury markets, highlighting critical shifts in investor sentiment. During her remarks, Yellen emphasized that the recent movements within the Treasury markets reflect a significant loss of confidence, rather than a sign of systemic dysfunction.

Continue reading

Trump's Liz Truss Moment: How the UK is Awakening to the Bond Market's Authority

In the world of finance, trust and confidence are as crucial as any hard metric. In a recent wake-up call reminiscent of former Prime Minister Liz Truss's tumultuous economic decisions, the market is solidifying its stance as the true arbiter of the UK's financial trajectory. This scenario, compared to moments in the past when bold decisions led to rapid policy reversals, highlights the extent to which markets dictate much of economic stability.

Continue reading

BNP Paribas Adjusts South Africa's Growth Outlook Amid Political Turmoil and Tariff Conflicts

In a notable shift in economic forecasting, BNP Paribas has revised its growth projections for South Africa, attributing this change to the complexities of the political landscape and ongoing tariff disputes. The French banking giant has reduced its growth estimate for the nation significantly, underscoring the financial repercussions these factors could impose on the country's economy.

Continue reading

Deutsche Bank Predicts Fed May Resort to Emergency QE Amid Ongoing Bond Rout

In a striking analysis released recently, Deutsche Bank has warned that the ongoing upheaval in bond markets could compel the Federal Reserve to implement emergency quantitative easing (QE) measures. As bonds in the U.S. experience a pronounced sell-off, impacting yields and investor sentiment, economists at the bank highlighted the potential for significant intervention by U.S. monetary authorities.

Continue reading

Investment Banker Warns That Uncertainty Threatens South Africa's Deal Landscape

In a recent statement, a prominent investment banker emphasized the daunting challenges posed by uncertainty in South Africa's market, which could jeopardize numerous planned mergers and acquisitions. This warning comes at a time when the nation is grappling with economic volatility and fluctuating investor confidence, raising significant red flags for corporate deals in the region.

Continue reading

Chinese State-Backed Developers Surge Following Land Holdings Expansion

In a significant turn of events within the real estate sector, state-backed developers in China are experiencing a pronounced rally. This boost comes on the heels of new policies aimed at expanding land holdings, which have reignited investor interest and optimism in the market. The move represents a strategic shift amid the broader challenges faced by the construction industry in the wake of governmental scrutiny and economic pressures.

Continue reading

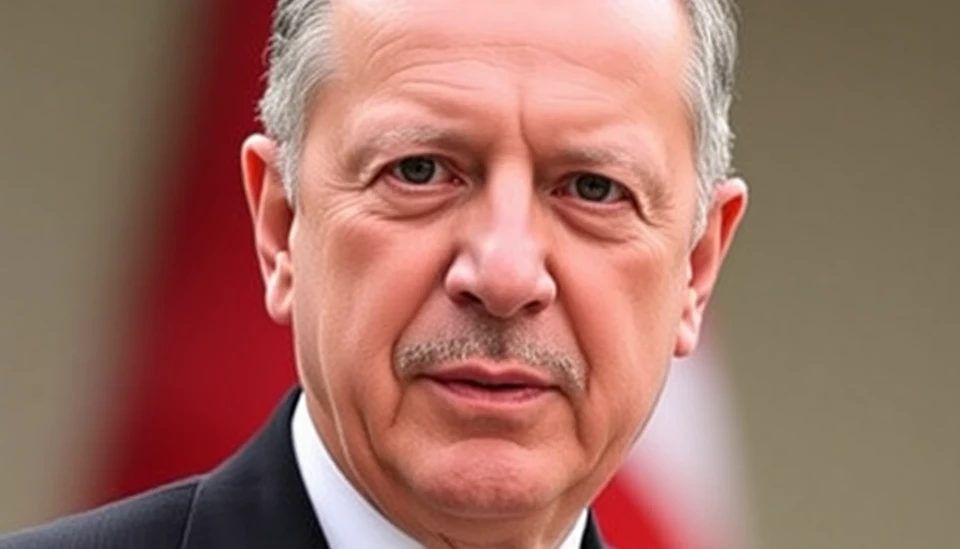

Turkish President Erdogan Navigates Protests and Market Instability

In a time of rising tensions and widespread discontent, Turkish President Recep Tayyip Erdogan is walking a fine line between addressing public protests and stabilizing the country’s financial markets. Recent demonstrations have erupted across Turkey, primarily fueled by widespread dissatisfaction with the government’s economic policies, rampant inflation, and the deteriorating living conditions that have left many citizens struggling to make ends meet.

Continue reading