Eni Adjusts Financial Outlook: Forecasts Lower Cash Flow Amid Strategic Cost-Cutting Measures

In a recent announcement, Eni SpA, the renowned Italian energy giant, has revised its forecast for cash flow, predicting a decline due to the ongoing challenges posed by a fluctuating energy market. Despite this setback, the company remains committed to its shareholder rewards program, keeping its stock buyback initiative intact by implementing a series of cost-reduction strategies.

Continue reading

US Dollar and Treasuries Receive Strong Endorsement from European Investors

In a significant turn of events this week, the US dollar and Treasury securities garnered notable confidence from European investors, indicating a robust outlook for American financial assets in the global market. Analysts observe that this growing faith in the dollar and Treasuries could be a strategic reaction to ongoing economic conditions across Europe and the United States.

Continue reading

Prosecutors Target Korea Zinc Offices Amid Controversy Over Failed Share Sale

In a dramatic turn of events, prosecutors have raided the offices of Korea Zinc, one of the leading non-ferrous metal producers in the world, as part of an investigation into a controversial share sale that has raised significant concerns about corporate governance and financial practices within the company.

Continue reading

Major Shifts in the Oil Market: Analysis and Latest Developments for April 23

As we approach the end of April 2025, recent analyses of the oil market reveal significant shifts that are reshaping the industry's dynamics. Prices have been experiencing notable volatility due to various geopolitical events, OPEC+ production strategies, and emerging economic trends. This article delves into the drivers of the current oil market conditions and provides insights on what to expect in the coming weeks.

Continue reading

RTX's Stock Takes a Hit Amidst Concerns Over Possible Tariff Impact on Business

In a recent development that has caught the attention of investors and industry analysts alike, RTX Corp. announced potential ramifications a new set of tariffs could have on its operations and profitability. Following this announcement, the company's stock experienced a notable decline, reflecting investor anxiety over heightened costs and market volatility.

Continue reading

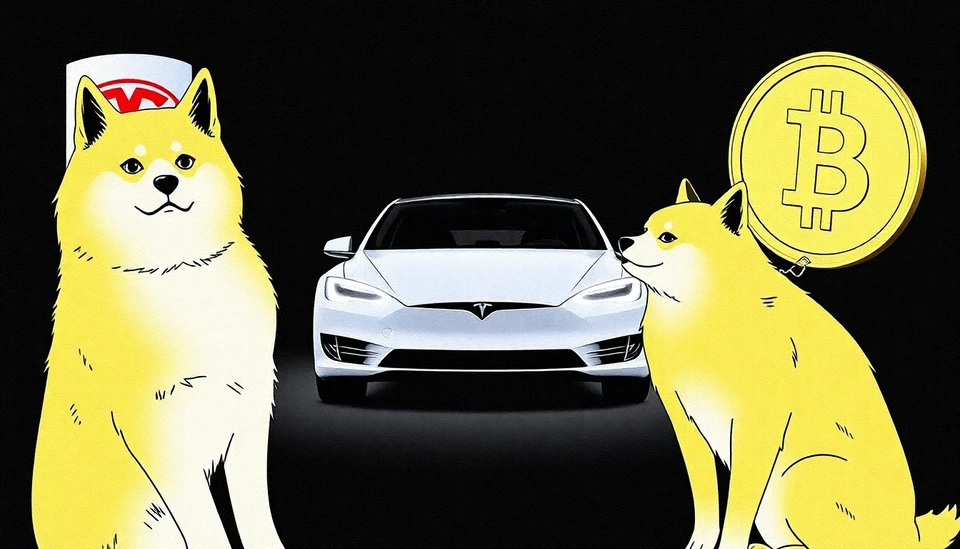

Tesla Investors Sound Alarm: Calls for Musk to Step Down from Dogecoin Role

In a stunning move that highlights the ongoing tension within the Tesla investment community, a prominent industry analyst has declared a "code red" for the company's stock performance, urging that CEO Elon Musk should detach himself from his involvement with Dogecoin. This drastic recommendation comes amid growing concerns that Musk's association with the meme-based cryptocurrency is adversely affecting Tesla a company that has always prided itself on innovation and sound business practices.

Continue reading

Snap-on's Challenges Rise as Tariffs Impact 'Made in USA' Appeal

In a recent turn of events, Snap-on Inc., a well-known American manufacturer of tools and equipment, has seen its shares decline amidst rising concerns surrounding tariffs. Despite the company's strong marketing push for its 'Made in USA' products, the reality of tariff implications appears to overshadow these efforts, leading to significant financial consequences.

Continue reading

Yen Faces Increased Volatility Ahead of Key Finance Minister Discussions

The Japanese yen is bracing for potential volatility as traders gear up for critical discussions led by Japan's Finance Minister. As the market anticipates fresh insights into economic policies, many are left speculating on the short and long-term impacts this could have on the currency.

Continue reading

Harley-Davidson Faces Investor Backlash: Calls for CEO Ouster and Board Overhaul

In a significant turn of events, Harley-Davidson, the iconic American motorcycle manufacturer, is under scrutiny as an activist investor escalates its efforts to demand the ouster of the company's CEO and a comprehensive overhaul of its board of directors. This call to action follows a series of disappointing financial results and strategic missteps that have left investors increasingly restless.

Continue reading

Star Shares Surge as Trading Resumes Following Planned Rescue Efforts

In a remarkable turn of events, shares of Star International saw a brief surge today as trading resumed following a well-publicized rescue plan aimed at stabilizing the company's operations. This resurgence comes on the heels of a significant financial restructuring that the company publicized just days earlier, revealing efforts to solidify its balance sheet and restore investor confidence.

Continue reading