Bristol Myers Squibb Surpasses Expectations, Upgrades Financial Forecast

Bristol Myers Squibb Co. has recently announced an upward revision to its financial outlook, fueled by stronger-than-anticipated sales from existing drug lines. The pharmaceutical giant posted impressive quarterly results, highlighting continued demand for its already established products, which played a significant role in boosting its revenue projections.

Continue reading

Norway's $1.7 Trillion Wealth Fund Faces Tech Stock Losses Amid Market Fluctuations

In a comprehensive financial report released recently, Norway's sovereign wealth fund, recognized as the largest in the world with assets totaling $1.7 trillion, has acknowledged a significant downturn driven predominantly by its investments in technology stocks. The report highlights that the fund experienced a notable decrease in value, attributed largely to volatility in the tech sector, which has been characterized by fluctuating investor sentiment and market dynamics.

Continue reading

Alaska Airlines Faces Setback as Profit Forecast Falls Short Amidst Diminished Demand

In a recent financial update, Alaska Airlines has reported that its anticipated profit for the upcoming quarter has fallen below market expectations, primarily due to a notable decline in travel demand. This revelation has sparked concern among investors and analysts who were hopeful for robust performance from the airline in the wake of a recovery from the pandemic.

Continue reading

CEOs Express Concerns as Market Turbulence and Tariff Risks Amplify Financial Crisis Fears

In a disconcerting turn of events for the global economy, numerous CEOs and business leaders have raised alarms over deteriorating market conditions, citing escalating tariff risks and uncertainty impacting stock performance and investor sentiment. Recent reports indicate a growing consensus among corporate executives that we are on the brink of a financial crisis, reminiscent of previous economic downturns.

Continue reading

Tesla Faces Challenges: Stock Price and Sales Decline Raise Concerns

Tesla Inc. is currently experiencing significant challenges as both its stock price and sales figures show a troubling downward trend. Investors and analysts are beginning to question the sustainability of the company’s growth in what has been a fiercely competitive electric vehicle market.

Continue reading

Equifax Surpasses Profit Expectations While Sustaining Economic Outlook Amidst Macro Risks

Equifax Inc., the leading consumer credit company, has recently reported its financial results for the first quarter of 2025, showcasing a robust performance that exceeded analysts' profit estimates. The company attributes its strong earnings to a combination of strategic initiatives and heightened demand for consumer credit services, despite ongoing macroeconomic uncertainties.

Continue reading

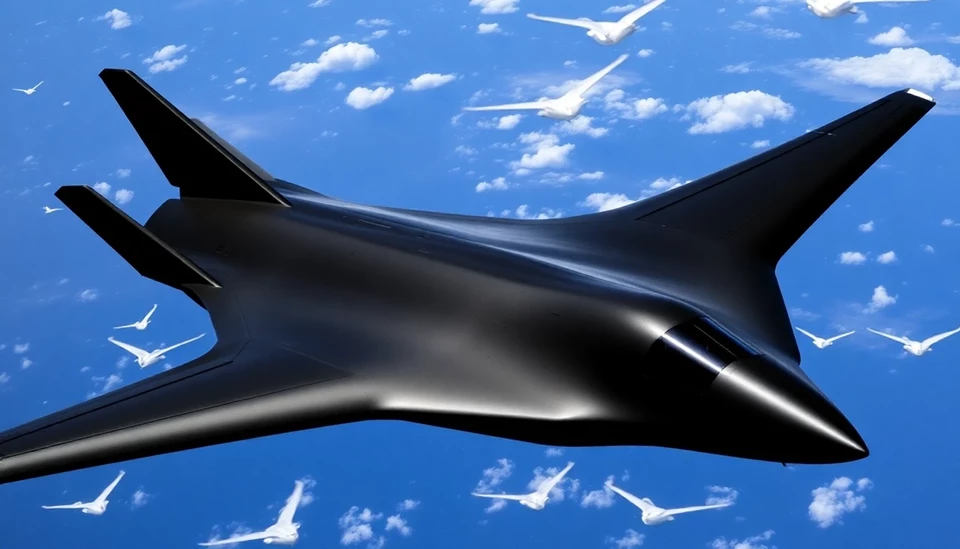

Northrop Grumman Adjusts Earnings Forecast Due to Stealth Bomber Expenses

In a significant announcement that has caught the attention of investors and industry analysts alike, Northrop Grumman Corporation has revised its earnings outlook for the fiscal year. The defense contractor's updated forecast is primarily influenced by rising costs associated with the development of its advanced stealth bomber program, the B-21 Raider.

Continue reading

RTX's Stock Takes a Hit Amidst Concerns Over Possible Tariff Impact on Business

In a recent development that has caught the attention of investors and industry analysts alike, RTX Corp. announced potential ramifications a new set of tariffs could have on its operations and profitability. Following this announcement, the company's stock experienced a notable decline, reflecting investor anxiety over heightened costs and market volatility.

Continue reading

L'Oréal's Luxe Division Boosts Shares with Strong Quarterly Sales

In a remarkable announcement, L'Oréal has reported a significant surge in its quarterly sales, particularly driven by the robust performance of its luxury division. This positive financial report has led to a noteworthy increase in the company's stock value, reflecting investor confidence in its brand strategy and product offerings.

Continue reading

Tesla Investors Sound Alarm: Calls for Musk to Step Down from Dogecoin Role

In a stunning move that highlights the ongoing tension within the Tesla investment community, a prominent industry analyst has declared a "code red" for the company's stock performance, urging that CEO Elon Musk should detach himself from his involvement with Dogecoin. This drastic recommendation comes amid growing concerns that Musk's association with the meme-based cryptocurrency is adversely affecting Tesla a company that has always prided itself on innovation and sound business practices.

Continue reading