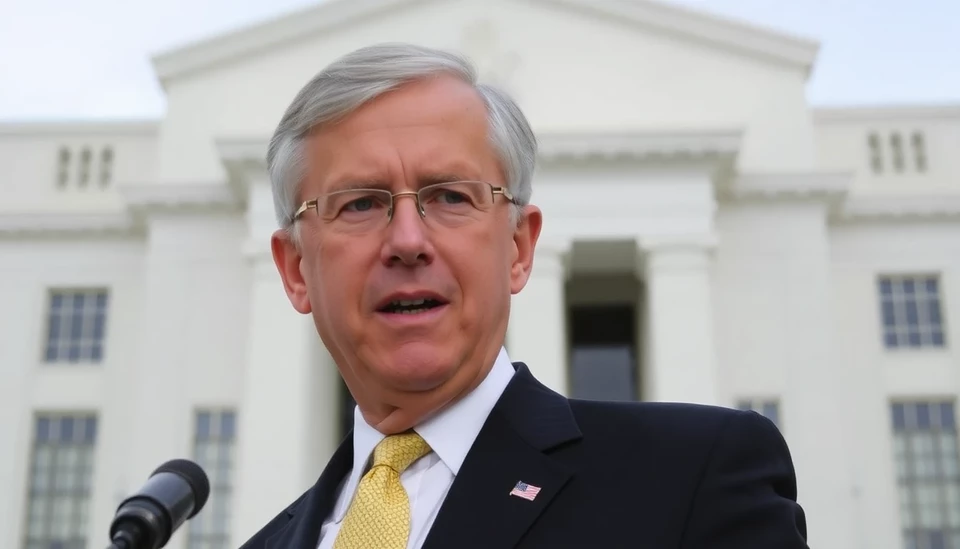

On March 7, 2025, Federal Reserve Chair Jerome Powell addressed concerns regarding the current economic climate and the potential for future interest rate moves. His statement underscored a cautious approach by the central bank amid ongoing uncertainties, marking a moment of stability in a fluctuating economic environment.

In a speech that captured the attention of market analysts and investors alike, Powell emphasized that the Fed is not under immediate pressure to alter its interest rate strategy. This perspective aligns with the underlying economic indicators, which suggest a moderate recovery while still grappling with lingering inflationary pressures.

Powell reiterated that the central bank remains committed to its dual mandate: ensuring price stability while maximizing employment. He pointed out that recent data has shown some positive trends in the job market, helping to strengthen the economy. However, he cautioned that inflation rates remain a concern and need to be monitored closely.

During the presentation, Powell addressed the delicate balance the Fed must maintain. He noted that while the economy is showing signs of resilience, any decision regarding interest rates must be carefully considered in light of various economic signals, including consumer spending, inflation rates, and global economic conditions.

The remarks came just ahead of the next monetary policy meeting, where many analysts were speculating on whether the Fed would take action on interest rates. By communicating a lack of urgency for immediate changes, Powell appears to seek to reassure markets that the Federal Reserve will proceed judiciously and with a long-term perspective in mind.

In conclusion, Powell's address reflects a calculated approach from the Federal Reserve as it navigates a path through an evolving economic landscape. The emphasis on careful assessment rather than hasty decisions may serve to stabilize market expectations and bolster confidence among investors and consumers alike, as all eyes now turn to upcoming economic indicators.

As the Fed continues to assess its strategy, the economic climate remains in a state of flux, making the upcoming months critical for shaping monetary policy going forward.

#FederalReserve #JeromePowell #InterestRates #MonetaryPolicy #Economy #Inflation #MarketStability

Author: Daniel Foster