Turkey's Financial Stability in Jeopardy Amidst Political Turmoil: The Arrest of Ekrem İmamoğlu

In an unprecedented turn of events, the political climate in Turkey has taken a dramatic shift following the recent arrest of Ekrem İmamoğlu, a prominent opposition figure and the Mayor of Istanbul. This incident has sent shockwaves through both political and financial arenas, raising concerns about the nation’s economic future, particularly its struggling lira and interest rates.

Continue reading

Goldman Sachs Forecasts Turkey to Increase Interest Rates to Stabilize Financial Markets

In a recent analysis, Goldman Sachs has projected that Turkey's central bank will be compelled to raise its main interest rate significantly in the wake of a tumultuous financial climate. This move is seen as a necessary step to calm market anxieties and restore confidence in the Turkish lira, which has been under severe pressure.

Continue reading

Turkey’s Opposition Takes Central Bank to Task Amid Economic Turmoil

In a significant move reflecting the growing discontent with Turkey's economic management, opposition leaders have fiercely criticized the Central Bank's recent interventions aimed at stabilizing the lira amidst rising inflation and market turmoil. The political climate has become increasingly tense as the nation's financial strategies come under scrutiny.

Continue reading

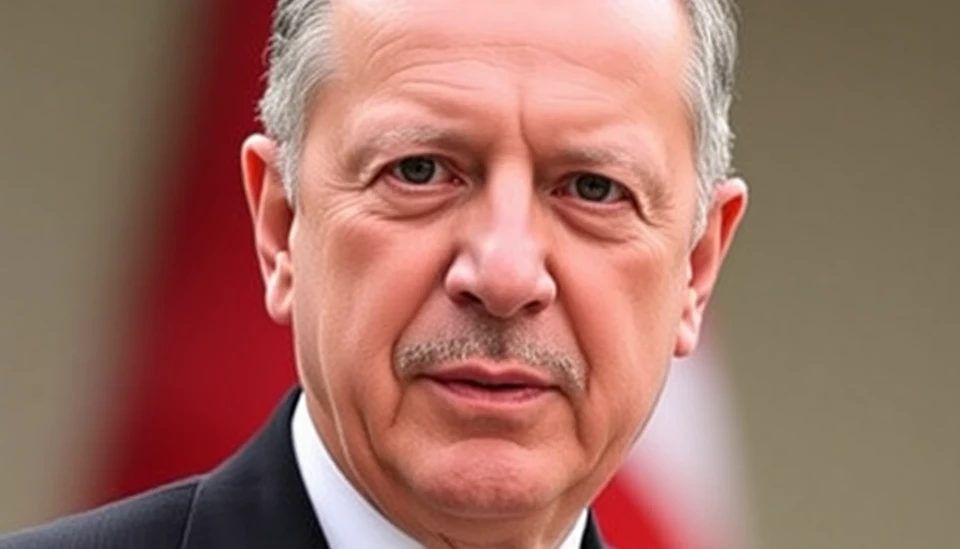

Turkish President Erdogan Navigates Protests and Market Instability

In a time of rising tensions and widespread discontent, Turkish President Recep Tayyip Erdogan is walking a fine line between addressing public protests and stabilizing the country’s financial markets. Recent demonstrations have erupted across Turkey, primarily fueled by widespread dissatisfaction with the government’s economic policies, rampant inflation, and the deteriorating living conditions that have left many citizens struggling to make ends meet.

Continue reading

Turkey's Finance Chief Plans Investor Meeting to Stabilize the Lira

In an effort to combat the declining value of the Turkish lira, Turkey's finance minister is set to engage directly with investors in a meeting aimed at restoring confidence in the national currency. The lira has faced substantial pressure recently, suffering losses that threaten the economic stability of the country.

Continue reading

Turkey's Şimşek Calls for Investor Confidence Amidst Market Turmoil

In recent days, Turkey's financial markets have faced significant turmoil, prompting the country's Treasury and Finance Minister, Mehmet Şimşek, to reach out directly to investors. This move comes after a notable sell-off in Turkish assets, raising concerns about the state of the economy and the ongoing measures to stabilize the market.

Continue reading

Erdogan Reassures Investors Amid Economic Concerns in Turkey

In a recent address, Turkish President Recep Tayyip Erdogan has reaffirmed his commitment to the country’s economic policy, seeking to alleviate apprehensions among investors regarding the nation's financial stability. This comes in the wake of mounting investor unease due to fluctuating exchange rates and rising inflation, which have both posed significant challenges to the Turkish economy.

Continue reading

Turkish Central Bank Initiates Meeting with Lenders Amid Market Turmoil

In a significant move reflecting escalating economic challenges, the Turkish Central Bank has announced an urgent meeting with lenders as it seeks to address growing market instability. This decision comes in the wake of fluctuating currency values and rising inflation that have recently plagued the country’s financial ecosystem.

Continue reading

Turkey's Central Bank Shocks Markets with Unexpected Rate Hike

In a surprising twist in the financial landscape, Turkey's central bank convened an emergency meeting, resulting in a significant decision to raise the overnight rate. This unexpected move stunned investors and analysts alike, igniting discussions about the future of Turkey's economy and its challenges surrounding inflation.

Continue reading

Turkey's Central Bank Cuts Interest Rates Again, Now at 42.5%

In a bold move signaling a change in its monetary policy direction, Turkey's Central Bank has decided to lower its benchmark interest rate for the third consecutive time, bringing it down to 42.5%. This latest reduction comes amid a backdrop of heightened inflationary pressures and economic uncertainties, making it a notable event for investors and economists alike.

Continue reading