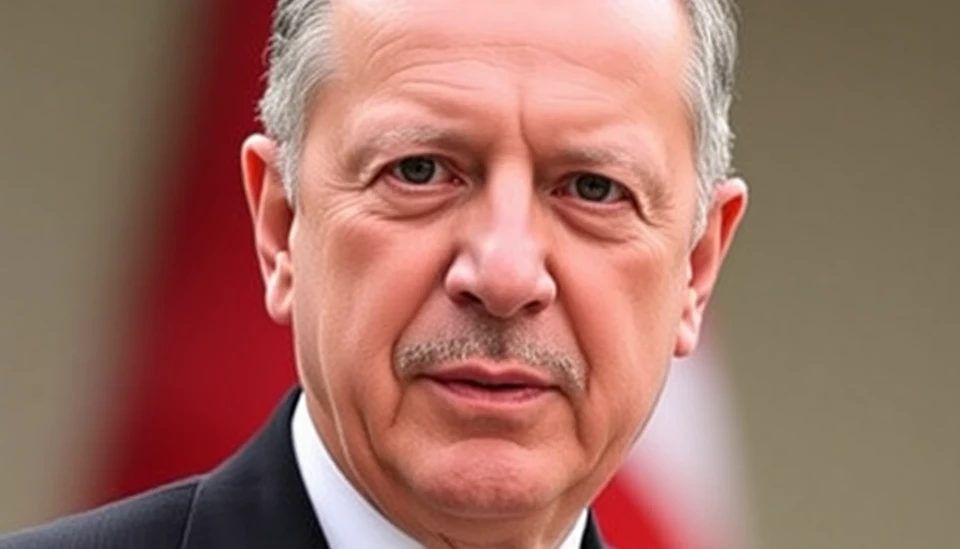

In recent days, Turkey's financial markets have faced significant turmoil, prompting the country's Treasury and Finance Minister, Mehmet Şimşek, to reach out directly to investors. This move comes after a notable sell-off in Turkish assets, raising concerns about the state of the economy and the ongoing measures to stabilize the market.

The call, scheduled for later today, is expected to address investors' worries and outline the government's strategy in response to the recent market rout. Investors have been particularly jittery following the government's continued commitment to its unorthodox economic policies, which many analysts believe have exacerbated inflation and undermined the lira.

Market analysts suggest that the recent drops in stocks and bonds are fueled by fears over potential policy shifts and a lack of confidence among foreign investors. With inflation remaining stubbornly high, touching double digits, and the lira persistently losing value against major currencies, Šimşek's call intends to reassure investors about the government's commitment to prioritizing economic stability and addressing these challenging issues head-on.

Over the past week, the Turkish stock market witnessed a dramatic downturn, alongside the fluctuations in the lira which have added to the investors' anxieties. The decision to initiate this investor conference indicates a proactive approach by the Turkish government to rebuild trust and encourage foreign capital inflow, which is crucial for the economy's recovery.

During the call, Şimşek is expected to highlight measures aimed at curbing inflation, reforming monetary policy, and restoring investor confidence. Investors will be keen to listen for any signals regarding future interest rate policies or adjustments in Government spending, which could provide relief amidst the current uncertainties.

As the economy navigates through these tumultuous times, all eyes are on this upcoming investor call which could have significant implications for Turkey's financial stability moving forward. Global investors are monitoring this situation closely, as a successful reassessment could potentially mark a turning point in restoring confidence in the Turkish market.

#Turkey #Finance #Investors #Şimşek #Economy #MarketStability #Lira #Inflation

Author: Rachel Greene