In a significant move that indicates growing skepticism about the British economy, Citi has reported that hedge funds are stepping up their selling of the British pound. This surge in activity comes just ahead of the anticipated UK government budget announcement, which is expected to outline crucial fiscal strategies in response to current economic challenges.

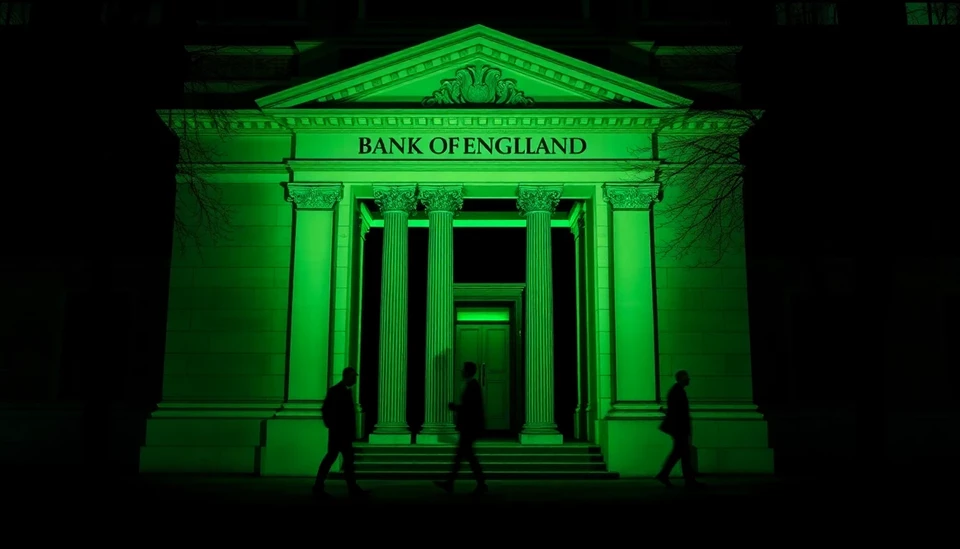

Market analysts are keenly observing these trading moves as they signal a shift in sentiment towards the pound, which has faced considerable pressure in recent months. Despite previous efforts by the Bank of England to stabilize the currency, hedge funds appear to be betting against the pound, evidence of their lack of confidence in the government's ability to effectively address ongoing economic issues.

The timing of these trades suggests that hedge funds are positioning themselves to capitalize on what they perceive as impending fiscal shortcomings. With the UK budget set to unveil critical economic measures, traders are speculating that the government may not provide the market with the reassurances it seeks. This anticipation has created a climate of uncertainty, pushing hedge funds to take more aggressive stances in the currency markets.

According to market sources, there has been an increase in the volume of short positions being taken against the pound, highlighting a belief among investors that the currency may continue to depreciate. Such strategies reflect a broader trend as institutional investors reassess their positions in light of potential government fiscal policies that may be unveiled in the budget.

Analysts note that the outcomes of this budget could be pivotal. Investors are particularly attentive to any indications of fiscal tightening or expansion, as these will directly influence market confidence and currency valuations. Given the current economic landscape characterized by inflationary pressures and a cost-of-living crisis, the government's proposals will be scrutinized closely.

The ongoing volatility in the UK economy, coupled with rising interest rates and geopolitical uncertainties, has contributed to a complicated backdrop for policymaking. As the government prepares to present its budget, stakeholders are bracing for a range of possible scenarios that could impact economic growth and stability.

As hedge funds continue to show their hand in the currency markets, the narrative surrounding the British pound is poised for further developments. Investors are advised to remain vigilant as they navigate these turbulent waters, with the upcoming budget serving as a critical juncture for both the currency and the broader UK economy.

In summary, Citi's insights reveal a shifting landscape for the pound, driven by hedge fund strategies that reflect deepening concerns over the UK’s economic trajectory. With the imminent budget announcement looming, the market remains on high alert for signals that could influence future currency movements.

#Pound #HedgeFunds #UKBudget #CurrencyMarkets #EconomicTrends

Author: Laura Mitchell