In a surprising turn of events, the British pound has rebounded sharply, reaching its highest value against the US dollar in 2025. This rally comes on the heels of a tumultuous start to the year, during which the currency struggled significantly compared to its global counterparts. Economic analysts are now examining the factors contributing to this impressive turnaround and the implications for the UK economy moving forward.

At the beginning of 2025, the pound was facing mounting pressure. Economic uncertainties, coupled with speculative traders positioning themselves against the currency, left it vulnerable. Many analysts noted that the pound had one of the worst starts of the year among major currencies, prompting concerns about the UK’s economic health and its ability to effectively navigate ongoing challenges.

However, recent developments indicate a shift in sentiment. The pound has not only recovered but is experiencing a notable climb, gaining traction amid a more optimistic outlook from investors. Factors contributing to this resurgence include improving economic data from the UK, which have been better than expected. Recent reports indicate stronger-than-anticipated retail sales, a revitalized labor market, and signs that inflation is beginning to stabilize.

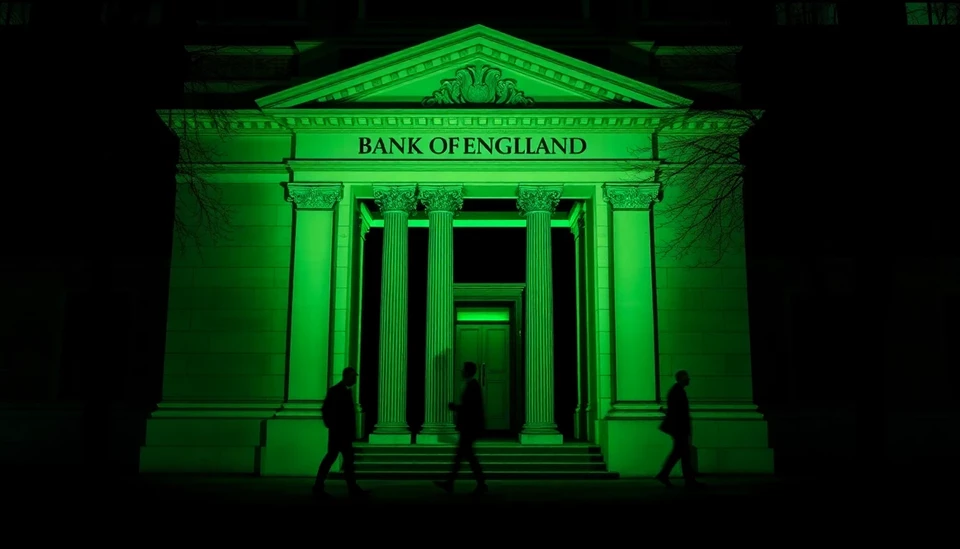

Additionally, the Bank of England's recent communications have also played a crucial role. By signaling a more hawkish stance on interest rates, the central bank has instilled confidence among investors. The expectation that monetary policy will tighten reinforces the pound’s position as a more attractive asset, thus fostering increased demand.

Market analysts are closely monitoring how this movement in the currency will influence broader economic trends. The pound's ascendancy could potentially bring relief to British exporters who have faced challenges due to previous currency fluctuations. A stronger pound generally means that overseas sales become less expensive for foreign buyers, potentially boosting demand for UK goods and services.

However, while the current climate seems favorable, experts caution that volatility may still lie ahead. Global economic conditions remain unpredictable, and factors such as geopolitical tensions or shifts in monetary policy from other nations could impact the pound’s performance. Therefore, while the currency is celebrating this recent high, the road ahead may be a mixture of opportunities and challenges.

In conclusion, the British pound's climb to a 2025 high marks a significant turnaround after a rough start to the year. The positive economic indicators and a supportive monetary policy from the Bank of England could herald a new chapter for the UK's currency and economic landscape, but vigilance remains essential as external factors could sway the future trajectory.

#Pound #CurrencyMarket #BankOfEngland #UKEconomy #Forex #EconomicRecovery #InterestRates

Author: Laura Mitchell