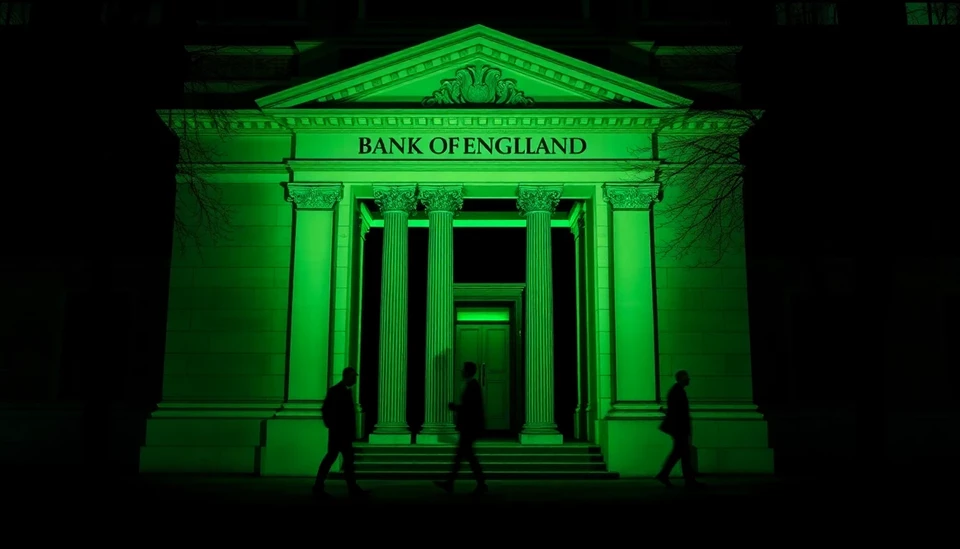

The British pound is poised for more declines in the wake of a recent warning from the Bank of England (BoE) regarding potential risks to the UK’s economic growth. This alert has sent ripples through financial markets, raising concerns among investors about the currency's stability in the prevailing economic climate.

As the central bank gears up for its policy meeting, it has indicated that the weakening of the pound is closely tied to domestic economic signals that suggest a slowdown. Analysts are now pondering the implications of these developments, particularly as inflationary pressures and global uncertainties mount.

The BoE has emphasized that while inflation seems to be stabilizing, the outlook for growth remains precarious. Several economic indicators have shown signs of weakening, which could hinder the recovery trajectory that policymakers have been banking on. With consumers grappling with higher living costs and businesses facing ongoing challenges, the path forward appears fraught with obstacles.

Market responses have already begun to reflect these sentiments, as traders have adjusted their positions in anticipation of forthcoming changes in monetary policy. The BoE's latest communication has prompted speculation about whether it might maintain or alter its interest rate strategies in light of nuanced economic signals.

Adding to the uncertainty, geopolitical tensions and external pressures continue to influence market dynamics, prompting traders to reconsider their outlook on the pound's strength. In this context, the potential for further devaluation looms large, particularly if key economic data releases confirm the Bank's cautious stance.

Market forecasts suggest that if the pound continues on its current trajectory, it could face significant headwinds. Investors are being urged to exercise caution and closely monitor forthcoming economic reports that could shape the Bank's monetary policy direction and, by extension, currency valuation.

As the UK's economy prepares for what many anticipate would be a challenging period ahead, the Bank of England's prudent acknowledgment of the prevailing risks serves as a critical touchstone for evaluating the prospects of the pound moving forward. The intertwined fates of the UK economy and its currency will undoubtedly emerge as a focal point in the coming weeks.

In conclusion, with the Bank of England signaling potential hurdles for growth and consequently the pound, market watchers are left to speculate on possible outcomes in a landscape characterized by volatility and uncertainty.

#Pound #BankofEngland #UKEconomy #CurrencyMarket #EconomicGrowth #Finance #Investors

Author: Rachel Greene