The Pound's Resilience: Will It Reach 1.40 Amid Limited Trade Tariff Impact?

The British pound is experiencing a remarkable rally, with analysts from Vanguard projecting a potential rise to 1.40 against the US dollar. This optimistic outlook emerges despite growing uncertainties in global trade relationships and the ongoing effects of trade tariffs that many believed would severely impact the UK economy. Vanguard's analysis highlights that the expected damage to the UK's economic performance from these tariffs may be less significant than initially anticipated, leading to a more favorable currency outlook.

Continue reading

UK Currency Faces Bank Skepticism Amid Economic Uncertainties

Recent developments indicate that major banks are beginning to lose confidence in the UK currency as concerns mount over economic risks stemming from potential government spending cuts. This shift has raised alarms regarding the stability of the British pound and its attractiveness to both domestic and international investors.

Continue reading

Pound Surges to 2025 High Following Disappointing Start Among Global Peers

In a surprising turn of events, the British pound has rebounded sharply, reaching its highest value against the US dollar in 2025. This rally comes on the heels of a tumultuous start to the year, during which the currency struggled significantly compared to its global counterparts. Economic analysts are now examining the factors contributing to this impressive turnaround and the implications for the UK economy moving forward.

Continue reading

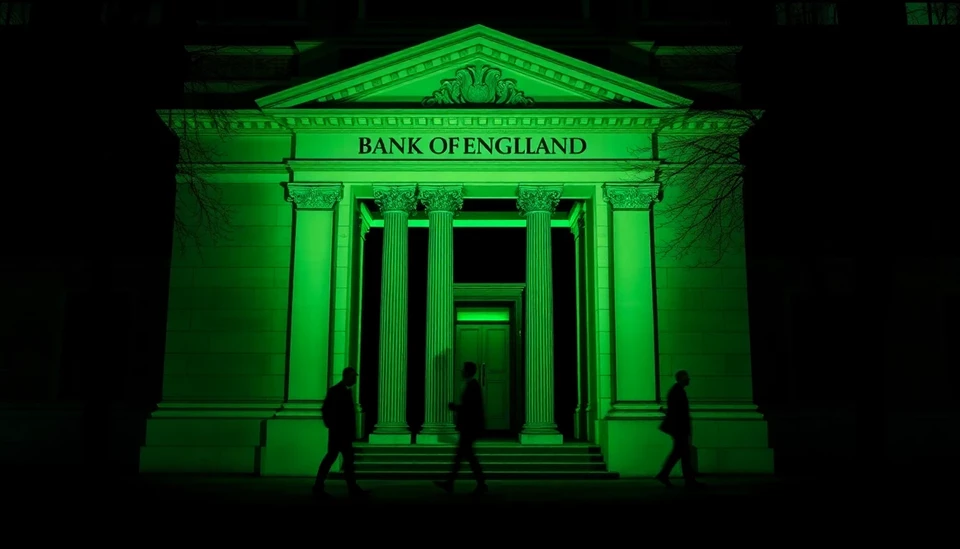

Pound Faces Further Decline as Bank of England Warns of Economic Challenges

The British pound is poised for more declines in the wake of a recent warning from the Bank of England (BoE) regarding potential risks to the UK’s economic growth. This alert has sent ripples through financial markets, raising concerns among investors about the currency's stability in the prevailing economic climate.

Continue reading

Pound Weakened by Lackluster UK Growth, Prompting Rate Cut Speculations

The British pound has experienced a notable decline following the release of disappointing economic growth figures from the United Kingdom. The latest data indicates that the UK economy is struggling to maintain momentum, which has analysts predicting an increasing likelihood of interest rate cuts by the Bank of England in the near future.

Continue reading

UK Pound Drops as Inflation Eases, Paving the Way for Potential Rate Cuts

The British pound has experienced a significant decline against major currencies following the announcement of a slowdown in UK inflation rates. This development has opened discussions about potential interest rate cuts by the Bank of England, stirring considerable market reaction and speculation among economists and investors.

Continue reading

Pound Dips to Lowest Point Since 2023 During Widespread UK Market Selloff

In a striking turn of events, the British pound has plunged to its weakest level since 2023, signaling a tumultuous period for the UK economy amid a broader selloff in the financial markets. As investors react to a combination of economic pressures, the currency's decline reflects growing concerns regarding the strength and stability of the UK’s future economic outlook.

Continue reading

2025 Forecast: Insights on the FTSE 100, Pound, and UK Markets

As we approach 2025, the UK financial landscape is poised for significant shifts, particularly in the performance of the FTSE 100 index, the British pound, and other market indicators. Recent discussions among financial analysts highlight the potential trends and developments that could shape the UK economy in the upcoming year.

Continue reading

Pound Soars to Highest Value Against Euro Since 2022 Amid Rate Decisions

The British pound has reached its highest level against the euro since 2022, reflecting a significant shift in the market's perception of interest rate trajectories in the UK and the Eurozone. As of the latest trading session, the pound was seen trading at a robust rate, gaining momentum against its European counterpart.

Continue reading

Egypt's Pound Plummets to Record Lows Amid Ongoing IMF Negotiations

In a concerning development for Egypt's economy, the national currency, the Egyptian pound, has hit its lowest value since March. This decline comes at a critical juncture as Egypt is engaged in ongoing discussions with the International Monetary Fund (IMF) regarding a bailout agreement and economic reforms.

Continue reading