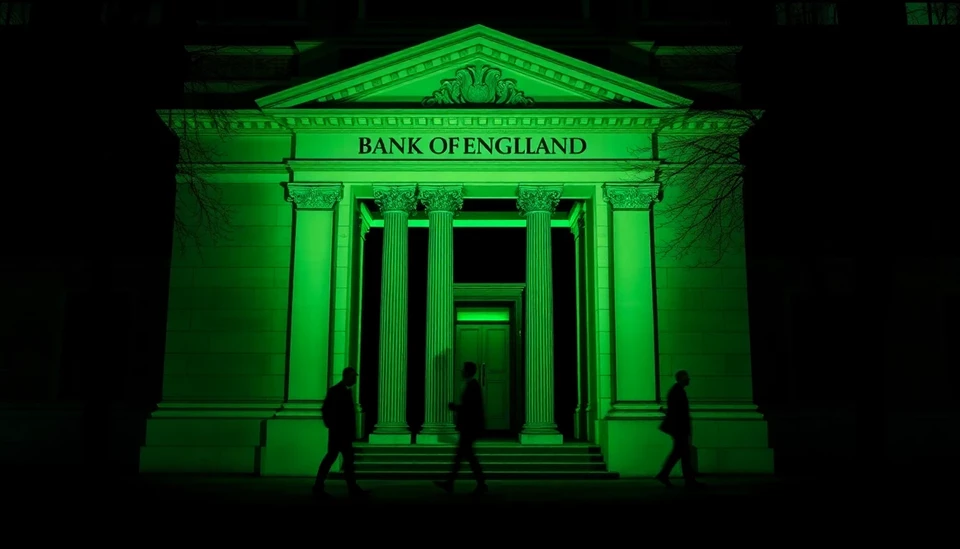

The British pound has experienced a significant decline against major currencies following the announcement of a slowdown in UK inflation rates. This development has opened discussions about potential interest rate cuts by the Bank of England, stirring considerable market reaction and speculation among economists and investors.

Statistics released by the Office for National Statistics revealed that UK inflation fell to 2.1% in December, down from 2.3% the previous month. This decline marks a notable shift in the economic landscape, raising questions regarding the forward trajectory of monetary policy in the UK. The easing of inflation came as a surprise to many analysts who anticipated a more stable figure, strengthening the argument for potential interest rate reductions.

In response to these inflation figures, the pound dropped sharply in trading on foreign exchange markets. Analysts noted a significant dip, highlighting that investor sentiment is reacting to the Bank of England’s potential shift in policy approach. If inflation continues on this downward trend, it could lead the central bank to reconsider its current stance on interest rates, which have remained relatively stable in recent months.

The implications of this inflation decline extend beyond just currency valuation; they also pose questions about the current economic recovery. As the cost of living pressures ease, consumers may feel some relief, which could influence spending habits that were previously restrained by high prices. However, this also poses risks for the broader economic recovery, as businesses may take a wait-and-see approach before making further investments or hiring.

Market observers have begun to recalibrate their expectations regarding the timing of any potential rate cuts. Many now believe that the Bank of England may look to lower interest rates sooner than previously anticipated, depending on how future economic indicators unfold. Such a move might not only affect the housing market and consumer borrowing costs but could also ripple through various sectors of the economy.

As discussions continue surrounding economic policy and inflation trends, the overall sentiment in currency markets remains cautious. Investors are likely to keep a close eye on upcoming economic data releases and statements from the Bank of England for further clarity on the trajectory of monetary policy in light of this recent inflation report.

In summary, the recent decline in UK inflation rates has led to a drop in the value of the pound, reigniting discussions about possible interest rate cuts. The economic landscape remains fluid, and it will be crucial for stakeholders to monitor how these changes affect the overall market and consumer behaviors moving forward.

#Pound #Inflation #InterestRates #BankOfEngland #Economy #ForexMarket #UKEconomy

Author: Laura Mitchell