The British pound has reached its highest level against the euro since 2022, reflecting a significant shift in the market's perception of interest rate trajectories in the UK and the Eurozone. As of the latest trading session, the pound was seen trading at a robust rate, gaining momentum against its European counterpart.

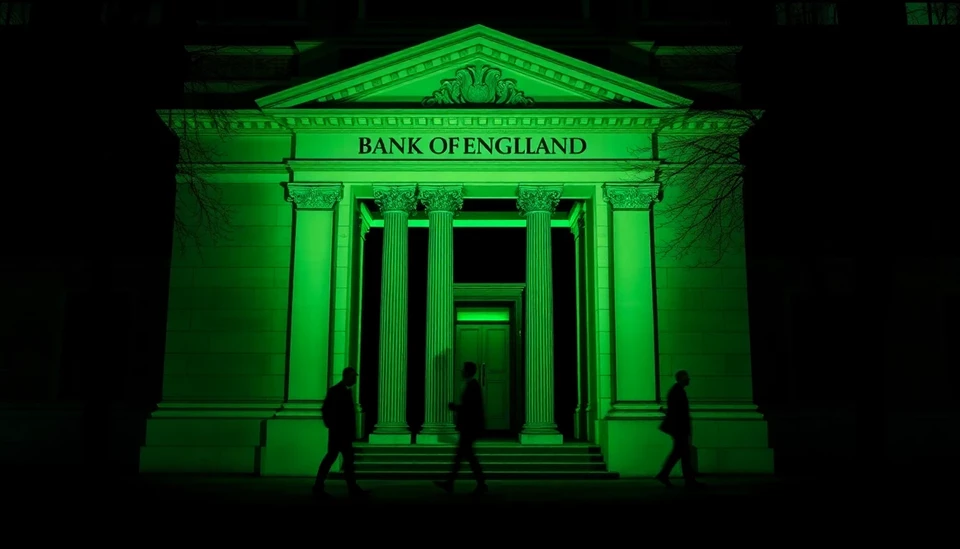

This surge in the pound's value is primarily driven by contrasting expectations regarding future interest rate policies between the Bank of England (BoE) and the European Central Bank (ECB). Analysts suggest that the BoE may adopt a more hawkish stance, hinting at potential rate hikes in response to ongoing inflationary pressures within the UK economy. Conversely, the ECB's outlook appears to be more dovish, focusing on maintaining current rates amid economic uncertainties in the Eurozone.

Investors are closely monitoring these central bank communications, which have led to a recalibration of currency valuations. The expectation of increased rates in the UK is seen as a bolstering factor for the pound, prompting traders to buy into the currency. This market sentiment has translated into a favorable performance for the pound, as it climbs above crucial resistance levels against the euro.

Market analysts note that this shift could have broader implications for trade and economic relationships between the UK and Eurozone countries. A stronger pound may affect British exports, making them more expensive for European customers, while simultaneously potentially reducing import costs from Europe.

The trading community will be keeping a keen eye on upcoming economic indicators, including inflation figures and employment data, which are expected to provide further clues about the direction of UK monetary policy. Any signs of sustained inflation could reinforce the pound's gains, pushing it even higher against the euro.

As the economic landscape continues to evolve, the dynamics between the pound and the euro will be a focal point for investors, businesses, and policymakers alike. This latest rally represents both a reflection of immediate market conditions and broader economic trends impacting the UK's financial future.

In conclusion, with the pound currently enjoying a significant uptrend against the euro, the implications of central bank policies and economic indicators will be crucial in shaping the currency's trajectory in the coming weeks.

#Pound #Euro #ForeignExchange #BankOfEngland #EuropeanCentralBank #CurrencyMarket #InterestRates #UKEconomy

Author: Laura Mitchell