In the latest financial developments, traders are increasingly adopting a bearish stance on the British pound due to growing concerns over the UK government’s budget strategies. According to Barclays, a significant rise in short positions against the pound is being observed as investors brace themselves for potential economic turbulence.

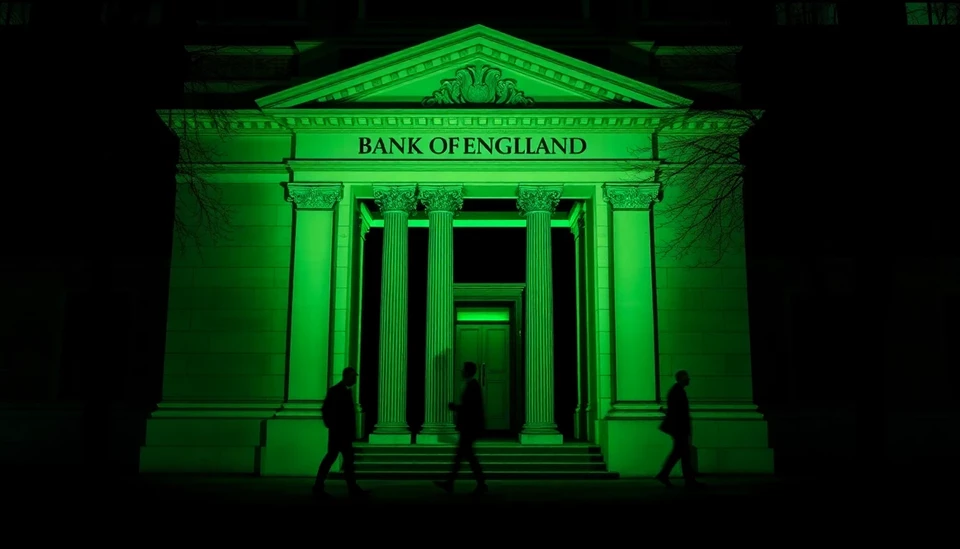

Market sentiment has deteriorated considerably following indications that the UK Treasury may pursue stricter fiscal measures. Analysts suggest that this shift reflects fears of heightened inflation and sluggish economic growth that could hinder the Bank of England’s monetary policy decisions.

The current economic climate underscores the precarious balancing act faced by the UK government and the central bank. Investors are particularly wary of how proposed spending cuts could impact consumer confidence and overall economic stability. As such, Barclays has noted a marked increase in traders looking to profit from a potential decline in the pound’s value, as uncertainty looms over financial markets.

Moreover, the backdrop of ongoing geopolitical tensions and subdued global economic conditions further exacerbates the environment for the pound. With heightened volatility expected in the coming months, many traders are reassessing their positions, opting for short bets in anticipation of potential depreciation of the currency.

The accumulation of short positions reveals a stark contrast to previous market behaviors where the pound experienced relative stability. However, as budgetary constraints and the need for austerity come to the forefront, the outlook for the pound appears increasingly precarious.

Traders will be closely monitoring upcoming fiscal statements from Chancellor Jeremy Hunt, which are anticipated to provide clearer insight into government spending strategies and economic priorities. The outcome of these announcements could catalyze further shifts in trading strategies as market participants react to the potential implications for the British economy.

In conclusion, the financial landscape indicates a prevailing pessimism towards the pound, driven by budgetary anxieties and broader economic concerns. As traders ramp up short positions, the future trajectory of the currency remains uncertain, with many waiting for concrete fiscal developments to guide their investment choices.

#Pound #ForexMarket #UKEconomy #Barclays #TradingStrategies

Author: Daniel Foster